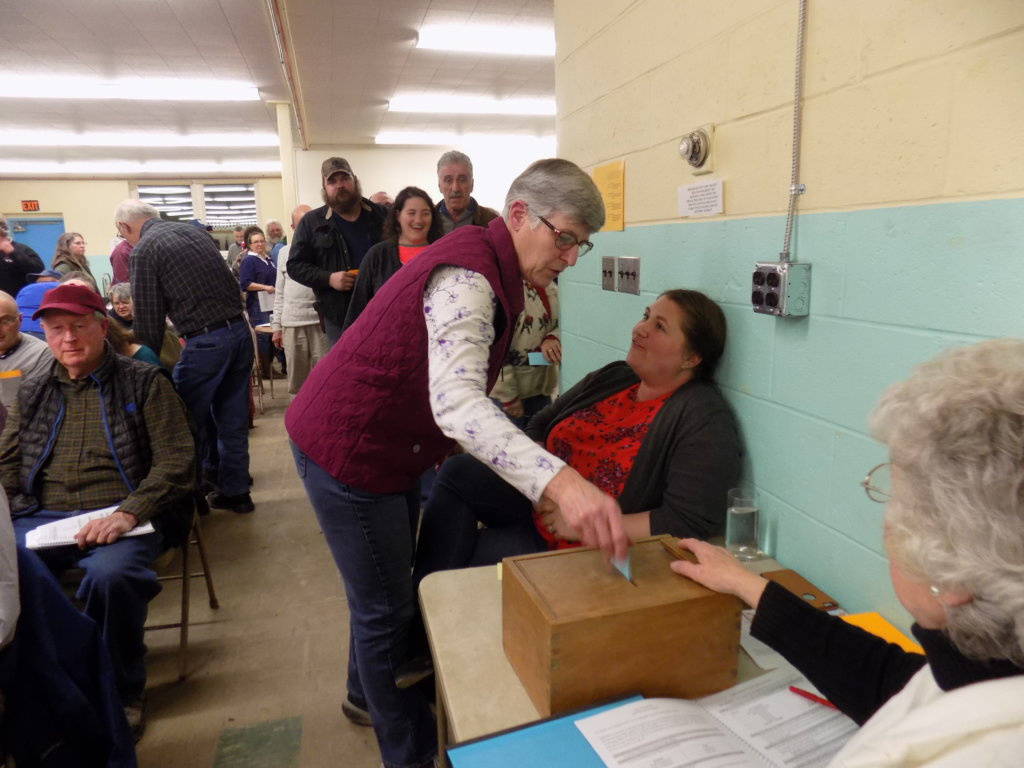

CHESTERVILLE — Voters at Town Meeting on Monday night approved of operating agency liquor stores seven days a week but rejected Sunday consumption on the premises.

Articles permitting agency liquor stores to operate Monday through Saturday passed 142-74, and operating them on Sunday passed 114-103.

Permitting consumption on the premises Monday through Saturday passed 114-98, but permitting consumption on Sunday failed 95-118.

Robert Wheeler, owner of The Corner Store, petitioned to have the articles on the warrant and said there would be no alcohol consumption at his store.

Voters opposed increasing the state’s municipal property tax limit. The vote was 30-35. The state law, L.D. 1, regulates the amount of money municipalities can raise through property taxes used for municipal operations.

Before the secret-ballot vote, Anne Lambert asked whether, if all articles were approved as presented, the amount would exceed the tax limit; and if so, how much.

Treasurer Erin Norton said it would be about $29,000 over if the highest amounts were approved.

Voters later rejected appropriating $163,282 for administration as suggested by selectmen.

Selectman Edward Hastings IV said he was concerned about cutting the budget to bare bones and cited a recent example of having to pay unexpected unemployment costs.

Budget Committee member Kathy Gregory said there was a significant increase in pay for town employees.

Resident David Gray asked if selectmen would take a cut in pay.

“You’re meeting half as often with the same pay,” he said.

Residents voted to reconsider the question and approved $159,782, which the Budget Committee had recommended.

Voters cut $51,494 from capital roads projects to bring the Road Committee’s recommendation in line with the $150,000 recommended by selectmen and the Budget Committee.

By a vote of 37-25, residents approved a 3 percent discount for property owners who pay their taxes within a month of getting their bill.

Outgoing Selectman Ross Clair said there were two sides to the issue.

“There’s $250,000 (in unpaid property taxes) on the books,” he said. “We’re charging 7 percent interest because people can’t pay their taxes. By getting that money, it gives us cash flow, which is better than borrowing money. We’re asking people who can’t pay their taxes to spend $40,000 to $45,000 for the discounts.”

Norton said the discount isn’t a good idea because large taxpayers, such as Central Maine Power Co., are taking advantage of the discount, while those who can’t pay their taxes are paying for the discount.

Hastings said he takes advantage of the discount.

“Every taxpayer can make that choice or another one,” he said.

In elections, Allan Mackey won a three-year selectman’s seat with 127 votes. His challenger, Daniel Morse, got 59. Maitland Lord Jr. won a one-year selectman’s seat with 69 votes. His challengers were Anne Lambert, with 65; Guy Iverson, with 52; and Carroll Corbin, with 27.

Send questions/comments to the editors.

Comments are no longer available on this story