WASHINGTON — House Republicans put forth a $2.2 trillion “fiscal cliff” counteroffer to President Barack Obama on Monday, calling for raising the eligibility age for Medicare, lowering cost-of-living hikes for Social Security benefits and bringing in $800 billion in higher tax revenue — but not raising rates for the wealthy.

The White House declared the Republicans still weren’t ready to “get serious” and again vowed tax rate increases will be in any measure Obama signs to prevent the government from the cliff’s automatic tax hikes and sharp spending cuts. Administration officials also hardened their insistence that Obama is willing to take the nation over the cliff rather than give in to Republicans and extend the tax cuts for upper-income earners.

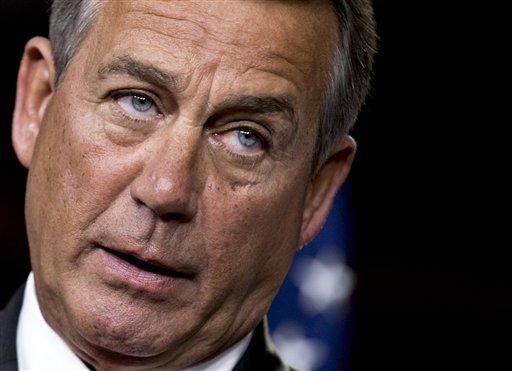

With the clock ticking toward the year-end deadline, House Speaker John Boehner, R-Ohio, and other Republicans said they were proposing a “reasonable solution” for negotiations that Boehner says have been going nowhere. Monday’s proposal came in response to Obama’s plan last week to raise taxes by $1.6 trillion over the coming decade but largely exempt Medicare and Social Security from budget cuts.

Though the GOP plan proposes to raise $800 billion in higher tax revenue over the same 10 years, it would keep the Bush-era tax cuts — including those for wealthier earners targeted by Obama — in place for now. Dismissing the idea of raising any tax rates, the Republicans said the new revenue would come from closing loopholes and deductions while lowering rates.

Boehner called that a “credible plan” and said he hoped the administration would “respond in a timely and responsible way.” The offer came after the administration urged Republicans to detail their proposal to cut popular benefit programs like Medicare, Social Security and Medicaid.

The White House complained the latest offer was still short on details about what loopholes would be closed or deductions eliminated, and it insisted that any compromise include higher tax rates for upper-income earners.

Asked directly whether the country would go over the cliff unless GOP lawmakers backed down, administration officials said yes. Officials said they remained hopeful that scenario could be avoided, saying the president continues to believe that going over the cliff would be damaging to the economy. And they signaled that Obama wouldn’t insist on bringing the top tax rate all the way back to the 39.6 percent rates of the Clinton era. The officials spoke on condition of anonymity because they were not authorized to speak publicly about internal White House deliberations.

“Until the Republicans in Congress are willing to get serious about asking the wealthiest to pay slightly higher tax rates, we won’t be able to achieve a significant, balanced approach to reduce our deficit our nation needs,” White House Communications Director Dan Pfeiffer said in a statement.

Boehner saw the situation as just the reverse.

“After the election I offered to speed this up by putting revenue on the table and unfortunately the White House responded with their la-la land offer that couldn’t pass the House, couldn’t pass the Senate and it was basically the president’s budget from last February,” he said Monday.

The GOP proposal itself revives a host of ideas from failed talks with Obama in the summer of 2011. Then, Obama was willing to discuss politically risky ideas such as raising the eligibility age for Medicare, implementing a new inflation adjustment for Social Security cost-of-living adjustments and requiring wealthier Medicare recipients to pay more for their benefits.

Monday’s Republican plan contains few specific and anticipates that myriad details will have to be filled in next year in legislation overhauling the tax code and curbing the growth of benefit programs.

Tine is growing shorter before the deadline to avert the fiscal cliff, which is a combination of expiring Bush-era tax cuts and automatic, across-the-board spending cuts that are the result of prior failures of Congress and Obama to make a budget deal.

Many economists say such a one-two punch could send the fragile economy back into recession.

GOP aides said their plan is based on one presented by Erskine Bowles, co-chairman of a deficit commission Obama appointed earlier in his term, in testimony to a special deficit “supercommittee” last year — in effect a milder version of a 2010 Bowles proposal that caused both GOP and Democratic leaders in Congress to recoil.

Unlike Bowles’ official 2010 plan, drafted with former GOP Sen. Alan Simpson, the version released Monday drops the earlier endorsement of Obama’s proposal to increase tax rates on family income exceeding $250,000 back to Clinton-era levels, with the top rate jumping from 35 percent to 39.6 percent.

Bowles, in a statement, said he was flattered but the GOP plan does not represent his proposal.

Still, he added, “Every offer put forward brings us closer to a deal, but to reach an agreement, it will be necessary for both sides to move beyond their opening positions.”

By GOP math, their plan would produce $2.2 trillion in budget savings over the coming decade: $800 billion in higher taxes, $600 billion in savings from costly health care programs like Medicare, $300 billion from other proposals such as forcing federal workers to contribute more toward their pensions and $300 billion in additional savings from the Pentagon budget and domestic programs funded by Congress each year.

Boehner signaled in discussions with Obama in 2011 that he was willing to accept up to $800 billion in higher tax revenues, but his aides maintained that much of that money would have come from so-called dynamic scoring — a conservative approach in which economic growth would have accounted for much of the revenue. Now, Boehner is willing to accept the estimates of official scorekeepers like the Congressional Budget Office, whose models reject dynamic scoring.

Under the administration’s math, GOP aides said, the plan represents $4.6 trillion in 10-year savings. That estimate accounts for earlier cuts enacted during last year’s showdown over lifting the government’s borrowing cap and also factors in war savings and lower interest payments on the $16.4 trillion national debt.

Last week, the White House delivered to Capitol Hill its opening proposal: $1.6 trillion in higher taxes over a decade, a possible extension of the temporary Social Security payroll tax cut and heightened presidential power to raise the national debt limit.

In exchange, the president would back $600 billion in spending cuts, including $350 billion from Medicare and other health programs. But he also wants $200 billion in new spending for jobless benefits, public works projects and aid for struggling homeowners. His proposal for raising the ceiling on government borrowing would make it virtually impossible for Congress to block him going forward.

Republicans said they responded in closed-door meetings with laughter and disbelief.

The GOP plan is certain to whip up opposition from Democrats opposed to any action now on Social Security, whose defenders say should not be part of any fiscal cliff deal. And Democrats also are deeply skeptical of raising the Medicare age.

Both ideas were part of negotiations between Boehner and Obama in the summer of last year.

In a letter to the president, Boehner and six other House Republicans insisted that the November election that returned Obama to the White House and the GOP to majority control in the House requires both parties to come together “on a fair middle ground.”

“With the fiscal cliff nearing, our priority remains finding a reasonable solution that can pass both the House and Senate, and be signed into law in the next couple of weeks,” Republicans wrote.

One of the few things the White House and Capitol Hill Republicans can agree to is a framework that would make a “down payment” on the deficit and extend all or most of the expiring Bush-era tax cuts but leave most of the legislative grunt work until next year.

Signing the letter was Boehner, House Majority Leader Eric Cantor, Majority Whip Kevin McCarthy and Rep. Paul Ryan, the chairman of the House Budget Committee and the unsuccessful GOP vice presidential candidate. Rep. Dave Camp, chairman of the Ways and Means Committee, Fred Upton, chairman of the Energy and Commerce Committee, and Cathy McMorris Rodgers, the Republican Conference chair, also signed the letter.

Earlier Monday, Obama answered questions on Twitter for an hour as the White House sought to keep up the pressure on the issue.

In response to a question about his insistence on higher tax rates for the wealthiest earners, Obama said that “high end tax cuts do (the) least for economic growth & cost almost $1T.” By contrast, he said, “extending middle class cuts boosts consumer demand & growth.”

Obama said he was open to “smart cuts” in spending, “but not in areas like R&D” and education, which “help growth & jobs.” He also said he opposes spending cuts that would hurt the disabled or other vulnerable groups.

Send questions/comments to the editors.

Comments are no longer available on this story