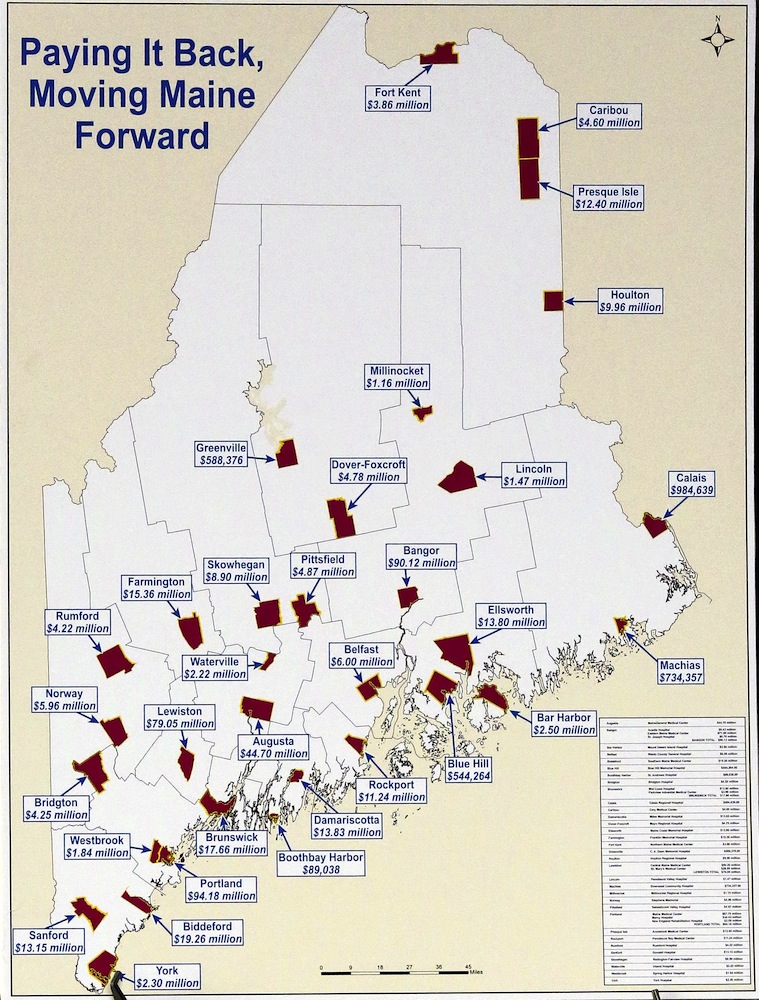

PORTLAND — Gov. Paul LePage announced a plan Tuesday to pay off $186 million in Medicaid debt to Maine’s 39 hospitals by issuing a revenue bond secured by future liquor sales.

Paying off the debt would help to protect the state’s credit rating and draw $298 million in federal Medicaid reimbursements to Maine’s medical centers, LePage said.

If the Legislature approves his hospital payment plan, he said, he will issue $105 million in voter-authorized general obligation bonds that he has so far refused to release.

That includes $51.5 million for transportation infrastructure improvements and $53.5 million for land conservation, clean-water improvements and higher-education construction projects.

“We pay the hospitals,” LePage said, “then I’ll issue the (other) bonds.”

LePage spoke at a rare news conference, held at the construction site of the University of New England’s dental college. He said his plan would inject $700 million into Maine’s economy in 2013, helping to preserve and create jobs, especially in construction and health care.

That infusion would include $100 million in government facilities bonds that LePage wants to issue to replace the Maine Correctional Center in Windham.

Steven Michaud, president of the Maine Hospital Association, was one of several hospital officials who praised LePage’s effort to make sure the state pays its overdue bill for Medicaid services.

Michaud said that paying hospitals what they’re owed would help create jobs, promote investment in medical infrastructure and increase access to health care.

Many hospitals have been cutting positions and borrowing against lines of credit “just to meet payroll” and pay other bills, he said.

LePage’s hospital payment plan calls for the state to regain control over liquor sales in a new contract to be negotiated this year. The state’s contract with the firm that now manages liquor sales and distribution runs out in mid-2014.

Under the new contract, the state would hire a firm to handle only distribution, Le- Page said.

The state made only $185 million on liquor sales in the last decade, the governor said, and it should make much more in the next decade, when liquor sales could hit $500 million.

“That’s leaving a lot of money on the table,” LePage said, calling the decision 10 years ago to hand over liquor sales to a contractor “an enormously bad decision.”

“I do not intend to do that in the future,” LePage said, noting that the contractor manages liquor sales from a small office in Augusta with nine employees.

The Republican governor said he has submitted emergency legislation that would authorize the state to issue a revenue bond to pay the hospital debt as soon as possible.

He said Republican legislators are on his side, but his measure needs support from at least two-thirds of the Democratic-led Legislature. Early indications are that a battle is brewing.

On Tuesday morning, LePage said, some legislators recommended that the state pay hospitals “just a percentage” of what they are owed, “a few bucks on the dollar, and call it a day.”

He clarified later that some legislators have said they would “prefer that I not pay the hospitals off because of the large wages that are paid to the CEOs and the big managers of the hospitals.”

House Speaker Mark Eves, D-North Berwick, said any additional revenue from a restructured liquor contract must be considered in the context of the state budget that the governor proposed last week.

That budget would eliminate funding for programs that help seniors buy medicine, gut property-tax relief, and suspend revenue sharing with cities and towns.

“The hospitals’ debt is one of the many competing obligations we have,” Eves said in a written statement after LePage’s news conference. “Our top priority must be to strengthen the economy and rebuild our middle class, not shift costs to Maine people and small businesses.”

Senate President Justin Alfond, D-Portland, said in a written statement “there are serious concerns about borrowing money to pay off our hospital debt. Asking Wall Street to pay our hospitals only leaves us in debt to Wall Street.”

Alfond said restructuring the liquor contract “is an opportunity for the state to negotiate a better deal — one where we bring more revenue in to the state, pay our bills and maintain good government.”

Staff Writer Kelley Bouchard can be contacted at 791-6328 or at:

kbouchard@pressherald.com

Send questions/comments to the editors.

Comments are no longer available on this story