During more than 25 years as a factory worker, David Young has seen a parade of robots take over tasks he and his colleagues used to do by hand.

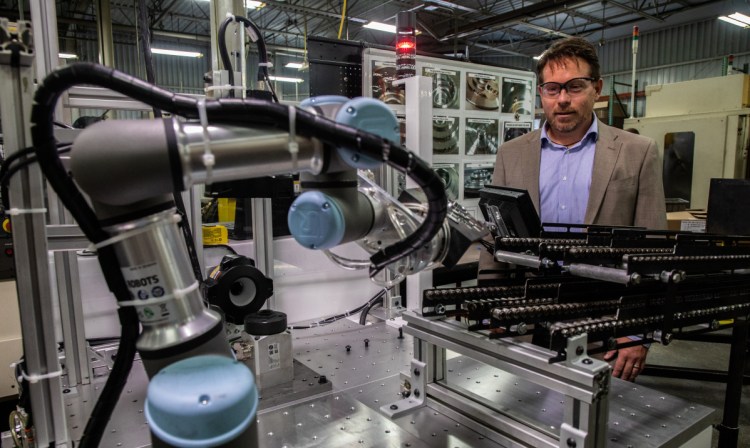

So Young, a machine operator, isn’t fazed by the sleek new “cobot” – collaborative robot – perched at his workstation at Kay Manufacturing in Calumet City, Ill.

The silver cobot, resembling a modern desk lamp, is being trained to do visual inspections of the automotive parts that Kay makes, its arm rotating the part so that an attached camera can detect any defects.

It’s a task that Young says he won’t miss doing himself, just as he doesn’t miss the manual work that gave him arthritis in his hands and feet before other robots took over those duties.

“It is hard to see every little thing,” said Young, 58. “This will make my job easier.”

Collaborative robots, one of the fastest-growing segments in robotics, are becoming an increasingly popular automation tool for manufacturers seeking to boost productivity.

Designed to augment the capabilities of human workers rather than replace them, cobots are billed as safe for people to interact with, easy to program and inexpensive to install – a potential game-changer for small- and mid-size manufacturers that have lagged their larger competitors in the automation game.

Whether cobots maintain their promise as human helpers rather than substitutes remains to be seen. Their impact on employment may not be so benign once the technology evolves beyond repetitive tasks and they become better at thinking and learning, said Darrell West, founding director of the Center for Technology Innovation at the Brookings Institution.

“I don’t think they represent a major threat to humans,” West said. “But the prices are coming down and these cobots are getting more sophisticated, so down the road they could.”

Cobot manufacturers insist the machines will free up their human colleagues to do more interesting jobs.

“There are endless needs for companies to get workers doing high-value tasks,” said Walter Vahey, president of the system test group at Massachusetts-based Teradyne, a leading supplier of industrial automation that owns two of the biggest cobot brands, Universal Robots and MiR.

Cobots, currently 3 percent of all robot sales, are forecast to have a 34 percent share by 2025, when global spending on robotics is estimated to hit $13 billion, according to the Robotic Industries Association.

Jurgen von Hollen, president of Denmark-based Universal Robots, calls the technology “the big equalizer” that will help smaller manufacturers grow amid challenges to hire and retain manual labor.

“We are in the embryonic stage of people understanding the potential. The challenge is to get that message across about what this can actually mean to a small company,” said von Hollen, whose company projects 50 percent annual sales growth over the next five years; it recently sold its 25,000th cobot to Kay, and this week one of its cobots rang the closing bell on the New York Stock Exchange.

Even unions representing manufacturing workers are excited about cobots, as “it is actually a cutting-edge thing to have humans and robots work in the same place,” said Brad Markell, executive director of the Industrial Union Council for AFL-CIO in Washington, D.C..

Losing jobs to automation, including cobots, is inevitable, Markell said. What matters is that employees have a voice in how the technology is used and are given training and access to the higher-quality jobs that might be created by the robots’ introduction, he said.

Brian Pelke, president of Kay Manufacturing, said robots have allowed the 72-year-old company to grow, and he expects his new cobots to give him an additional competitive edge.

Kay, which introduced robots to its plant in 1996, has never laid anyone off as a result of automation, Pelke said. Though its workforce declined to 40 from 120 during the Great Recession, Kay Manufacturing now has 180 employees across two factories. “If we didn’t have automation there would be no jobs,” Pelke said.

Kay purchased its first three cobots from Universal Robots this summer, after Pelke demurred for years because he worried the technology was too good to be true. He has been impressed with how quickly employees learned to use them.

Traditional industrial robots typically take six months to get up and running and work inside of $200,000 safety cages, Pelke said. Kay’s first cobot, which cost about $47,000, was fully deployed within 30 days, he said. It takes employees 87 minutes to complete the basic tutorial on how to program it.

In addition to being easy to program and repurpose for different uses, cobots are distinct from traditional industrial robots because of safety features that allow them to work side-by-side with humans. They automatically stop when they bump into an obstacle, and can be programmed to run at reduced speed when their sensors detect a human is nearby. They are limited in speed and how much weight they can hold.

On a recent walk through the Calumet City factory, Pelke, a former professional race car driver who took over the business from his father about 10 years ago, pointed to the various challenges he hopes cobots can solve. One example: three women standing around a bin inspecting completed wheel hub assemblies could be reassigned to higher-paying jobs driving forklifts or operating machines if a cobot does that work, Pelke said.

“We want them to use their brains more than their hands,” he said.

One of Kay’s cobots helps machine operators spot visual defects on auto parts. Humans, who can get tired or distracted, only catch defects nine times out of 10.

At Kay’s plant in St. Joseph, Mich., a cobot helps package completed parts. Pelke estimates he is saving $150,000 a year by shifting packing duties away from the machine operators, who can focus instead on changing tools, measuring parts and making adjustments to the process. And employees are earning more money as productivity rises, thanks to a program that awards them a bonus based on the prior week’s performance.

“It is really helping us compete in a very aggressive environment,” he said. “Without this solution we wouldn’t be winning the work we are winning.”

Though the market for collaborative robots is still emerging, their roots can be traced more than 20 years back to a Northwestern University engineering lab in Evanston, Ill. Mechanical engineering professors Michael Peshkin and Ed Colgate partnered with General Motors to design robots that would help the car manufacturer’s employees with assembly, and in 1996 founded Cobotics.

Cobotics – later sold to Stanley Assembly Technologies – departed from the conventional vision of robots at the time, which saw a future in autonomous machines.

Instead, the idea was for humans and robots to work hand in hand, combining the superior capabilities of robots, such as lifting heavy things, with the tasks humans do better, such as adjusting to unexpected changes, Peshkin said. The strategy represented a less expensive way to ease ergonomic issues and boost productivity because it didn’t require redesigning the factory around the robots.

The cobots being marketed today have departed some from the inventors’ original vision. Rather than close physical human-robot collaboration, they tend to focus on user-friendly design, Peshkin said.

As manufacturers roll out various types of human-friendly robots, there is some debate about what counts as a cobot; the International Federation Robotics is working on an official definition.

Omron, a global automation manufacturer with U.S. headquarters in Hoffman Estates, debuted its first collaborative robot arm this week at the Pack Expo convention at McCormick Place. With a longer reach and higher weight capacity than some existing models, plus an integrated camera in its head, the cobot “is like having another set of hands available to the worker,” said Mike Chen, president of Omron’s automation division.

Some say another form of collaborative robot is the autonomous mobile robot, a wheeled box-like creature that self-navigates through factory or warehouse floors delivering items. Autonomous mobile robots, whose safety features allow them to mingle with humans, can operate in fleets of up to 100 at a time, managed through a system much like air traffic control, Chen said.

The Danish company MiR, a leading supplier of mobile industrial robots, had its roving robots rolling around the floors at McCormick Place recently during the International Manufacturing Technology Show, pausing when they sensed an object or person in their path.

Within the next six months, MiR plans to launch artificial intelligence that allows the robot to detect whether the obstacle in its path is human or an object, so that it can decide whether to stop or go around it, said MiR CEO Thomas Visti. Another goal of the company is to make the wheeled robots so easy to use that a customer can take them out of the box and install them immediately, like Ikea furniture or an iPhone, Visti said.

Some companies outside of manufacturing are finding creative uses for the human-friendly bots. A film production studio purchased a Universal Robots cobot arm to mount a camera for fast-moving shots along a pre-programmed trajectory, and a California startup is working on using a robot arm to perform deep-tissue massages.

Mobile robots are being used in hospitals in Europe to deliver pharmaceuticals to patients’ rooms, their cargo locked in a chamber that can only be accessed by the appropriate doctor or nurse, Omron’s Chen said. He envisions them in airports, helping travelers with disabilities transport their bags to their gates.

Some of the more futuristic uses – like delivering beverages to customers in restaurants – are already happening in parts of Asia, which has embraced robots faster than the U.S. and dominates the world in robot adoption. The U.S. is the No. 4 sales market for industrial robots, according to the International Federation for Robotics. China is No. 1 and the fastest growing. South Korea and Japan are Nos. 2 and 3.

Despite excitement about cobot technology, many applications are still limited and the platform is young, said Stephen Laaper, a principal at Deloitte Consulting who advises companies on incorporating automation.

Safety concerns are holding back some of the collaborative uses. Employers are being cautious while they figure out how intimate humans should be with their robotic helpers and what tasks are most appropriate for them to team up on, Laaper said. After all, the safety features may not help much if the mechanical arm is handling blow torches.

As capabilities continue to advance, cobots will have a critical impact on the workforce, but Laaper believes it will be positive. Cobots will help employers fill mundane roles they struggle to find people to do and give rise to new positions that demand a different skillset.

“There is a net add to the workforce because there are more skilled operators required, and additional maintenance personnel,” Laaper said.

Helping people transition to new jobs, rather than mass unemployment, will be the greatest challenge as cobots and other forms of automation proliferate, research suggests.

Four out of five U.S. manufacturers are preparing for an increase in automation, and a fifth say they plan to shrink employee count as a result, according to a survey this year by L.E.K. Consulting. Half plan to upgrade the skillsets of their workforce.

Up to a third of the U.S. workforce may need to change occupations by 2030 as automation upends a variety of industries, from manufacturing to retail, according to a McKinsey Global Institute report. Some 39 million jobs in the U.S. could be displaced by automation by then, but the losses can be more than offset by new occupations and concerted efforts by governments and business leaders to create more jobs, the report said.

The challenge is the risk of mismatch between the positions available and what employees can or want to do, said West of the Brookings Institution. For the transition to be successful, the country will have to adopt a model for lifelong learning and launch new programs to retrain workers for more advanced jobs, he said.

To Markell, of the AFL-CIO, the key to peaceful coexistence with automation is to create quality employment throughout the economy so that factory workers eventually displaced by their cobot colleagues aren’t forced into low-pay, unsustainable jobs.

“They key is making all the jobs we have decent jobs,” he said.

Send questions/comments to the editors.

Comments are no longer available on this story