WASHINGTON — The draft House tax plan is going nowhere in the Senate as written.

The legislation to enact $1.41 trillion worth of tax cuts would run afoul of a Senate budget rule without substantive changes that would either raise more government revenue or scale back some of the benefits directed toward businesses and individuals, according to experts on Senate procedures.

“This bill would not become law as is,” said Marc Goldwein, policy director at the Committee for a Responsible Federal Budget.

The conflict with Senate rules is just one example of the hurdles Republicans will need to overcome to get the tax overhaul through Congress to make good on a central promise of President Trump’s campaign and carry a major accomplishment into the congressional elections next year. They also are still wrangling with dissenters within their ranks over multiple provisions including ending deductions for state and local taxes and levies on payments U.S. companies make to offshore affiliates.

In order to fast-track the tax legislation through the Senate without having to rely on support from Democrats, Republicans are using a budget process known as reconciliation. That means rather than needing 60 votes to keep the bill moving, Republicans – holding only 52 seats – can proceed with a simple majority of 51 votes to pass the legislation.

To qualify for the Senate’s reconciliation process, the bill must meet the terms of an adopted budget resolution and adhere to rules developed by and named for the late Robert Byrd, the West Virginia Democrat who served as majority leader from 1987 to 1989.

The House plan passes the first test. The fiscal 2018 budget resolution does not allow a tax bill to add more than a total of $1.5 trillion to deficits over 10 years, and the Joint Committee on Taxation’s initial assessment of the measure puts the bill’s cumulative shortfall at $1.41 trillion over a decade.

The red flag is raised after 2027. The nonpartisan joint committee’s analysis shows the plan adding $156 billion to the budget shortfall in that year, a sure sign that it will add to the deficit in 2028. That would trigger the Byrd rule, giving Democrats an opening to raise an objection to the bill on the Senate floor that would require 60 votes to overcome.

“The bill has a massive Byrd rule problem,” said Bill Hoagland, a former Republican Senate Budget Committee staff director.

Goldwein said looking at the official score, the corporate tax rate of 20 percent would likely have to snap back to 35 percent in the 11th year to make the bill comply with the Byrd rule. Alternatively, some of the revenue increases in the bill could be boosted, he said.

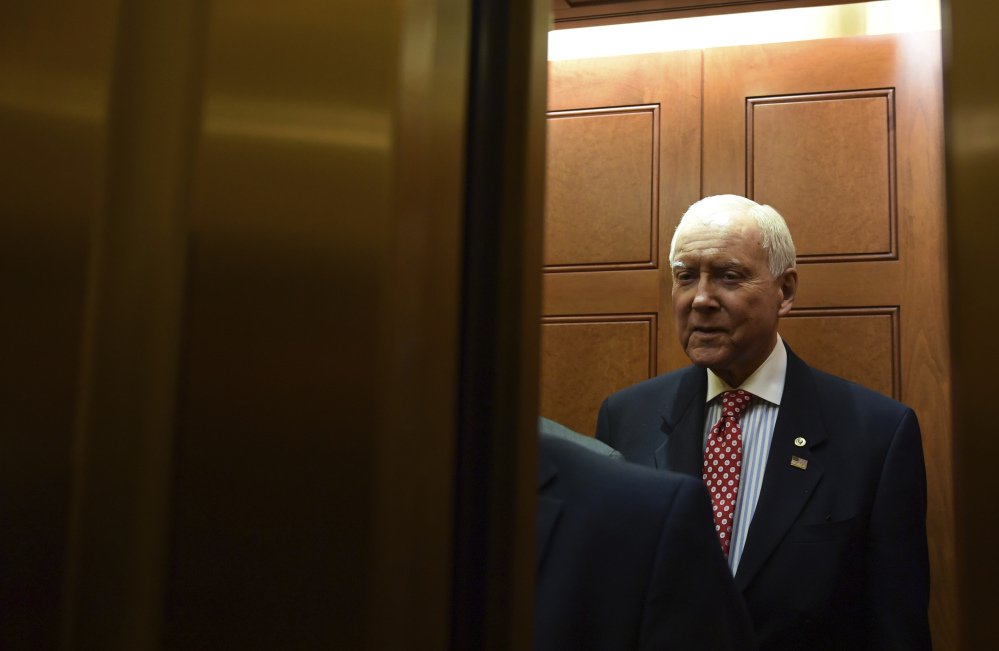

Senate Finance Committee Chairman Orrin Hatch plans to release his version of the tax plan by the end of this week.

Republican lawmaker Devin Nunes, a member of the tax-writing House Ways and Means Committee, acknowledged that the Senate may have to phase out cuts to keep the bill within the requirements.

“The Senate, under their rules, a lot of their stuff has to phase out,” he said.

A House Republican aide acknowledged the problem, saying the committee is aware of the constraints and will be working to ensure the bill complies with the rules by the time it is sent to the Senate.

House Ways and Means Chairman Kevin Brady on Friday made some technical changes to the legislation released the day before, and he said the panel will begin the real work of “making more substantive improvements to the bill” when it meets on Monday. He promised that work will be finished Thursday after “four days of open, full-throated debate.”

But each change has the potential to bring budgetary or political challenges.

During the drafting of the House bill, Brady considered phasing out the new 20 percent corporate tax in part because of worries about Senate rules. Under pressure from conservatives in the Republican conference, Brady backed off for now.

Adding that back in to meet Senate rules would renew conservative objections in the House and Senate and draw Trump’s ire. Further scaling back the mortgage tax deduction could further alienate moderate Republicans.

Already to limit the bill’s revenue losses, the House bill phases out its new $300 family tax credit after five years and Republicans added a $500,000 debt cap on the home mortgage interest deduction late in the drafting.

Send questions/comments to the editors.

Comments are no longer available on this story