Maine set a record for home sales in 2016, and local real estate professionals say the momentum fueled by a strong economy and low interest rates has carried over into 2017.

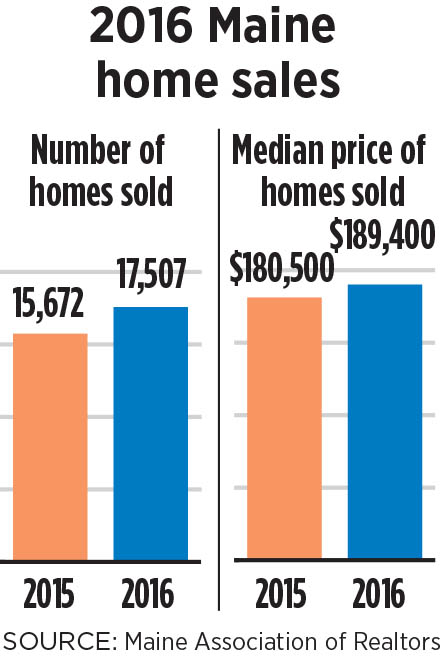

The number of homes sold in Maine increased nearly 12 percent from 2015 to 2016, according to data released Tuesday by the Maine Association of Realtors, easily besting the national year-over-year increase of 0.7 percent.

The 2016 sales year ended with 17,507 transactions statewide, the highest number in the 18 years the association has been tracking sales, said Greg Gosselin, president of the Realtors association and owner of Gosselin Realty Group in York.

“Indeed, last year was a very good year for real estate and home ownership,” he said.

In Maine, 2016 ended with a median home price of $189,400, a 4.9 percent increase over 2015. The national median home price for 2016 was $233,900, a 4 percent increase over 2015. A median price means half the homes sold for more and half sold for less.

But all that activity has touched off a reaction. With a record number of homes being sold, the market is running into a problem – a lack of inventory.

“It is absolutely crazy right now. It is totally limited,” said Vicki Kennedy, owner of RE/MAX Oceanside in Cape Elizabeth. “This is definitely the lowest inventory I’ve seen pretty much ever.”

COMPETITION, LIMITED INVENTORY

Cumberland County had the highest number of home sales in 2016, at 4,252, but it saw the lowest increase in the state, up just 2.68 percent over the 4,141 sales in 2015. It also had the highest median price, $265,000, a 6 percent jump over the $250,000 in 2015. York County had the second-highest volume of sales, 3,122, up 11.78 percent, and second-highest median price, $239,000, a 5.75 percent increase.

There is intense competition over the limited inventory in the Portland area, Kennedy said. Multiple offers and bidding wars are common, and some sellers are accepting offers within 48 hours of listing their home, she said.

“It is a perfect time for anyone who wants to sell something and doesn’t need to turn around and buy something in the same area,” Kennedy said. Buyers are increasingly looking farther north and inland to find better properties and prices, she said.

Home prices in the Portland area have largely recovered from the Great Recession, said John Reed, president and CEO of CUSO Home Lending, a mortgage company in Hampden owned by Maine credit unions.

“The Realtors basically say if you are going to list your house, you better pack your bags because it is going under contract in seven to 10 days,” Reed said.

In other parts of the state, prices are rising but still are not near the highs before the market crash in 2008, Reed said.

Franklin County saw the greatest increase in sales, from 313 to 392, a 25.24 percent jump. Knox County saw the greatest increase in median sales price, rising nearly 16 percent from $183,500 in 2015 to $212,000 in 2016. Aroostook County saw the greatest median price decrease, by about 5 percent from $87,250 to $82,500.

Even though interest rate increases are expected, the housing market should remain strong, Reed said, noting that the current interest rate on a traditional 30-year mortgage is about 4 percent.

“Last year was our biggest year ever for our company, and we are way ahead of last January, so that is a good way to start the year,” he said.

QUIET HOLIDAYS, then A surge

At the Maine Real Estate and Development Association forecasting conference last week, David Marsden of the Bean Group presented on the state of the southern Maine residential market. He, too, commented on the lack of inventory and predicted that home prices were likely to increase 2 percent to 4 percent in 2017 and that interest rates would remain below 5 percent.

Nationally, December home sales were anemic, decreasing 2.8 percent from November. The slide was attributed to low inventory and economic tensions, according to a news release from the National Association of Realtors.

“Solid job creation throughout 2016 and exceptionally low mortgage rates translated into a good year for the housing market,” Lawrence Yun, chief economist for the National Association of Realtors, said in the release. “However, higher mortgage rates and home prices combined with record-low inventory levels stunted sales in much of the country in December.”

In Maine, December home sales were up more than 11 percent over December 2015, but down nearly 2 percent from November.

Despite the late 2016 slump, the housing market showed a lot of activity in the first weeks of 2017, Gosselin said.

“I think people are being much more positive. We are seeing a lot of activity around the state in January,” he said.

FHA PREMIUM CUT INCENTIVE

Reed, the CUSO Home Lending CEO, said it’s unlikely that the Trump administration’s suspension of a proposed cut in premiums for Federal Housing Administration mortgage insurance, announced in the last days of President Barack Obama’s administration, would have much impact.

FHA insurance allows new home buyers to secure mortgages with low down payments. The Obama administration proposed reducing FHA premiums a quarter of a percent to offset interest rate increases. The cut could have saved households around $500 a year.

Critics said lowering insurance rates could leave the FHA vulnerable in the event of a large number of foreclosures. National Association of Realtors President William E. Brown, from Alamo, California, said the group intends to work with the FHA to explain why a premium rate cut is necessary.

“Without the premium reduction, we estimate that roughly 750,000 to 850,000 home buyers will face higher costs, and between 30,000 and 40,000 would-be buyers will be prevented from entering the market,” Brown said in a written statement.

But Reed said it is typical for new administrations to pull back from old policies, and he expects the FHA insurance issue will be resolved.

“I think it is just temporary. I don’t see any major move either way,” he said.

Peter McGuire can be contacted at 791-6325 or at:

Send questions/comments to the editors.

Comments are no longer available on this story