A paper recycling company from India has expressed interest in buying Catalyst Paper Corp., including its mill in Rumford.

Kejriwal Group International, based in Mumbai, has sent a letter to the majority owners of Catalyst, saying it would offer $6 per share for the British Columbia-based company. Kejriwal is affiliated with the company that expressed interest in buying Verso Paper’s Bucksport mill in January 2015. That mill ultimately was closed and sold for scrap.

Catalyst’s board of directors said Monday it would evaluate the offer.

“(We are) encouraged by KGI’s proposal, which could provide the company with a significant amount of capital, which further enhances and accelerates Catalyst’s planned growth initiatives,” the board said in a statement.

Catalyst bought the Rumford mill, which makes coated paper, from NewPage Holdings in January of 2015 for $62.4 million. It employs 640 people, according to mill officials.

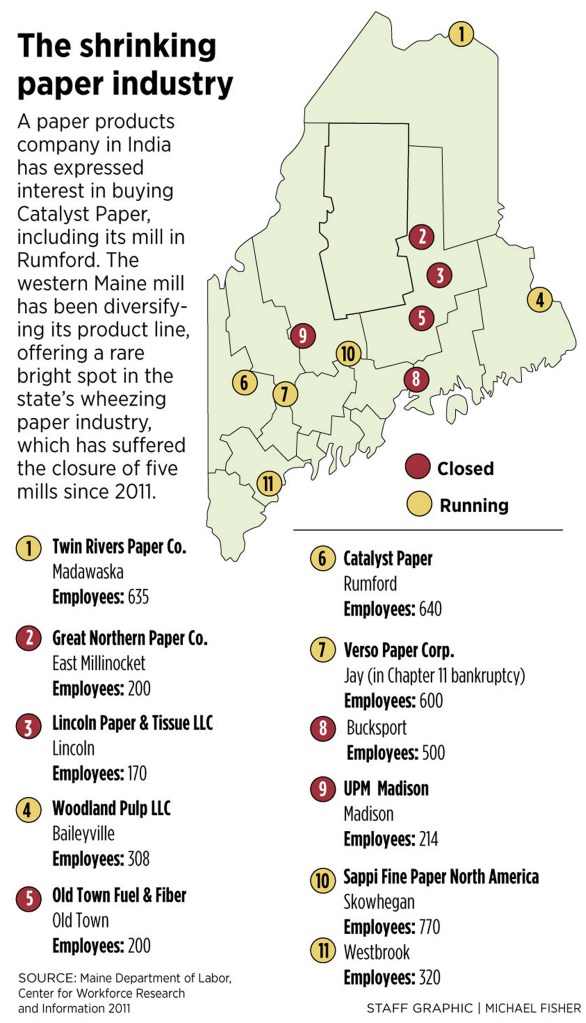

The Rumford mill has been a bright spot in what has been a generally dismal run of news for Maine’s paper industry. In April, the mill restarted an idled paper-making machine to diversify its product line, a move that restored 51 jobs.

Mill spokesman Tony Lyons said at the time that Catalyst started to develop new products to diversify its offerings in the global pulp and paper market. One of those new products is Rumford Offset, a specialty grade paper that is coated on one side and intended for use in marketing materials.

“We’re trying to develop more options, away from commodity grades,” Lyons said.

The state’s paper industry has lost 2,300 jobs since 2011, as five mills have closed in the wake of declining demand and changing consumer habits in global markets.

The letter laying out the terms of the acquisition said if Kejriwal’s offer is accepted, the company would be obligated to invest $60 million into Catalyst’s operations within a year of the closing.

The deal would need to be struck between Kejriwal and the four investment firms that own 79 percent of Catalyst: Mudrick Capital Management, Oaktree Capital Group Holdings, Cyrus Capital Partners and Stonehill Capital Management. The majority shareholders have 30 days to reach an agreement with Kejriwal, according to documents filed with the Securities and Exchange Commission.

News of Kejriwal’s interest on Monday sent Catalyst stock soaring. After closing at 45 cents a share on May 20, the stock had reached $5.75 per share when the markets opened Tuesday. It moderated to $4.26 per share in late afternoon trading Friday.

Catalyst owns another U.S. mill, in Biron, Wisconsin, and several mills in Canada, employing a total workforce of about 2,800 people. In 2015, it reported sales of roughly $2 billion.

Kejriwal Stationery Holdings Ltd, which manufactures and distributes paper-based and recycled stationery products, is a subsidiary of the Kejriwal group, according to Bloomberg. The company was formerly known as Greenearth Education Ltd.

Rahul Kejriwal, chief executive of the Kejriwal group, sent a letter to District Court Judge John Woodcock dated Jan. 16, 2015, expressing interest in purchasing the Bucksport mill. But the letter arrived too late to be entered into the official court record, Woodcock ruled, allowing a previous agreement between Verso and metal recycler AIM Development LLC to stand.

Send questions/comments to the editors.

Comments are no longer available on this story