BANGOR — Marshall Swan blames his wife, former Chelsea Selectwoman Carole Swan, for filing five years of false federal income tax returns, his attorney said during his trial in U.S. District Court today.

Walter McKee told the eight women and six men of the jury that the income for Marshall Swan Construction was under-reported for the tax years 2006–2010, but that Swan himself was unaware of it.

McKee held up large poster boards to illustrate his opening statement. They showed a division of labor at Marshall Swan Construction, giving Marshall Swan responsibility for doing the construction and estimating work for the earth-moving and snowplowing firm.

It showed Carole Swan as responsible for bookkeeping, banking and providing tax information to the professional tax preparer.

“The person dealing with the bookkeeping, accounting and taxes was Carole Swan and Carole Swan only,” McKee said.

In July, a different federal jury found Carole Swan guilty of two counts of workers’ compensation fraud and five counts of falsifying income tax returns. Then in September, she was convicted of three counts of extortion for taking kickbacks from a local contractor.

While McKee said Carole Swan was solely responsible for the income tax filings, the prosecutor, Assistant U.S. Attorney Donald Clark, blamed both Marshall and Carole Swan for the false filing.

“Each year, the defendant and his wife substantially under-reported the actual income that Marshall Swan Construction earned,” he said.

Clark told jurors, “It was no small error,” saying that they reported $2.4 million, failed to report an additional $650,000 and paid almost no income tax in the years 2006-2010.

He said the business money was deposited into two accounts in addition to the single business account, and that Marshall Swan endorsed the checks that went into the other accounts.

Last week, Chief Judge John A. Woodcock Jr. granted Clark’s motion to dismiss a pending charge of aiding and abetting federal program fraud related to Marshall Swan’s work on a $398,000 culvert project on Windsor Road in Chelsea in 2007.

Carole Swan was cleared of a charge that she defrauded the federal program over that project, which was largely funded by the Federal Emergency Management Agency.

At that same trial, Patricia Flagg, who prepared the Swans’ tax returns for the past 31 years, testified that she based them on figures supplied to her by Carole Swan.

Today, as soon as the attorneys finished their 15-minute opening statements, Clark called a series of 10 witnesses who testified they paid Marshall Swan or Marshall Swan Construction for excavating and for snowplowing or for gravel and loam for themselves or their company or organization.

In written filings, the prosecutor listed 36 witnesses he expected to call and an additional 90 who might be referred to during the trial. Most of the witnesses were the same individuals who testified at Carole Swan’s trial in July.

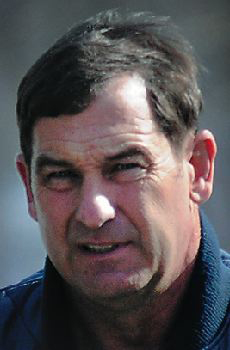

Marshall Swan, identified by several witnesses as the man “in the blue plaid shirt,” appears to have lost weight since he was initially arraigned on the charges 18 months ago. He leaned over occasionally to talk to his attorney while the prosecutor questioned witnesses, but otherwise he said nothing in court today.

Some of those who testified today:

• Abby Cassidy, of Commercial Properties Management LLC, testified that the firm paid Marshall Swan Construction more than $500,000 for plowing at Augusta Plaza on Western Avenue, eventually getting a seasonal contract rather than paying by the snowstorm.

• Lacie Clark, of Hallowell, office manager of Clark’s Cars & Parts, a scrap metal recycler, testified the firm paid Marshall Swan Construction $9,829 for both scrap metal and for moving items. Clark said she called Swan once to get his tax identification number and he told her to call Carole Swan for it.

• Michael Provencher, associate director of Motivational Services, which handled plowing contracts for the Edmund S. Muskie Federal Building in Augusta, paid Marshall Swan Construction more than $400,000 over a five-year period.

• Frances Simard, of Chelsea, testified she paid Marshall Swan Construction $24,000 in advance for earthwork on property she was purchasing from Carole Swan. “She stipulated I would have to have Marshall Swan do the groundwork,” Simard said. “I had to prepay for the earthwork so I could purchase the property.” She said she had to hire someone else to complete the work.

• Kelly Veilleux-Minoty, of Chelsea, testified she gave $7,000 or $9,000 in cash to Carole Swan at the Swan residence for groundwork for new construction at 307 Windsor Road. “I counted it out to Carole,” Veilleux-Minoty said.

She told the prosecutor she had no invoices or bills.

“It didn’t matter to me because I was getting a receipt,” Veilleux-Minoty said.

Testimony is expected to resume Tuesday at 8:30 a.m.

Betty Adams — 621-5631

badams@centralmaine.com

Send questions/comments to the editors.

Comments are no longer available on this story