Joseph Luka of Portland started college as a pre-med student, but switched to mechanical engineering because the thought of graduating with more than $100,000 in student loans after medical school was too daunting.

Luka, who has cobbled together a combination of federal Stafford loans, Pell Grants and savings from summer jobs to pay for college, estimates he’ll have to repay about $35,000 in loans when he graduates from the University of Southern Maine.

“It’s scary, but I think that without it I wouldn’t be able to be in school at all,” Luka said of the loans.

Although the recession is over, costs and concerns about job loss and tuition hikes are still driving families’ and students’ decisions on which colleges to attend and what to major in, according to an annual survey released by loan giant Sallie Mae on Tuesday.

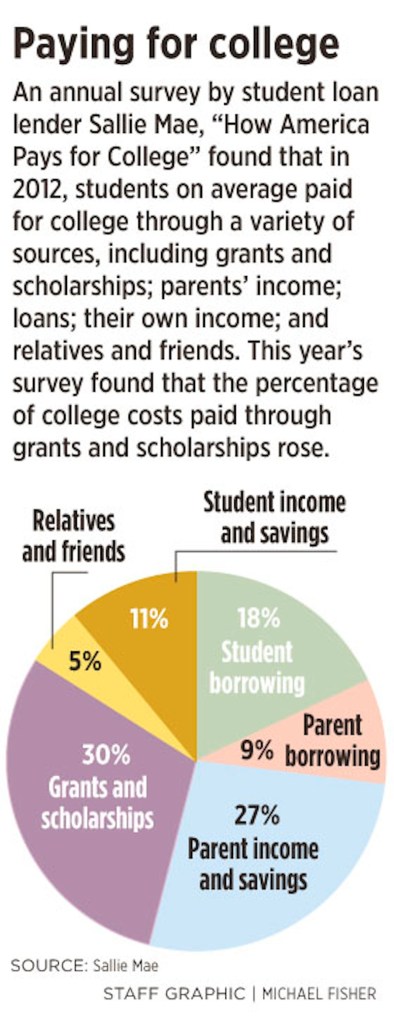

Nationally, grants and scholarships have become the leading source of money for college, and students are relying less on money from their parents and loans, the report said.

Last school year, the average family received grants and scholarships that covered 30 percent of college costs. Parents’ income and savings covered 27 percent of the bill and student loans covered 18 percent.

In 2009-10, money from parents was the largest source of a student’s college money, at 30 percent of the cost. Since then, parents’ total out-of-pocket spending per year per student has dropped by 35 percent, to $5,700 from $8,700, according to the Sallie Mae report. Students were awarded about $6,300 in grants and scholarships in 2011-12.

“Parents are willing to stretch themselves,” Ducich told the Associated Press. “It’s not that they’re not willing to pay. It’s that their income is not keeping up.”

Parents’ enthusiasm for college has not diminished, though. The survey found that 85 percent of parents saw college bills as an investment in their children’s future.

Nationally, college spending per student was about $21,000 during 2011-12, down from a peak of $24,000 in 2009-10, according to the Sallie Mae-Ipsos Public Affairs report.

The Ipsos telephone poll was conducted between April 10 and May 9 with 1,802 parents of undergraduate students and 800 18- to 24-year-old undergraduate students. The survey had a margin of error of plus or minus 2.5 percentage points.

According to a separate study by the College Board, the average sticker price at public colleges is now $17,860, including room and board. Students pay, on average, $12,110 per year. At private four-year colleges, the average full tuition price is now just under $40,000, with the average student paying $23,840.

In Maine, 71 percent of students had debt upon graduation in 2011 and the average debt load was $26,046, College InSight found.

By comparison, about two-thirds of the national college class of 2011 had loan debt at graduation, and their debt averaged $26,600, according to the most recent figures from the California-based Institute for College Access and Success. That was an increase of about 5 percent from the year before.

The issue of financing rates for student loans was the subject of debate in the Senate last week, as lawmakers considered a compromise that would offer some students lower rates for the next few years but assign higher rates in the future. A Senate vote is expected this week.

The White House estimates the average undergraduate student would save $1,500 in interest charges if Congress acts to lower Stafford Loan rates for the next few years from 6.8 percent to 3.4 percent before leaving town for the August recess, The Associated Press reported.

Watching Congress debate student loan rates has been stressful for Samantha McAvoy of Waterville, who is in the graduate school program for clinical mental health counseling at USM. McAvoy, who has about $5,000 in debt from her undergraduate schooling, expects to accumulate another $25,000 in debt while obtaining her graduate degree.

“It’s been really stressful to watch. Congress is not hard on corporate banks, but they’re taking a hard line with student loans. That doesn’t make sense,” McAvoy said. “The only way to go up in pay scale and move up economically in order for us to pay back our loans, we need to borrow more to get a better degree.”

According to the Sallie Mae report, one-fifth of parents worked longer hours to pay for their children’s college education, and half of students increased their work hours, too.

Rob Remien of Raymond is one of those students. He worked for three years as a physical therapy assistant to amass $45,000 in savings to help pay for school.

“I worked a lot of extra hours to help pay for school,” said Remien, a health sciences student at USM. Remien is in the process of applying for financial aid to pay for graduate school so he can get a job as a physician assistant.

Meanwhile, Emily Downs of Portland, who also is studying health sciences at USM, said she’s juggled three jobs and adjusted her course hours to manage school. She’s also got five loans totaling $19,000 to cover the rest of her school tuition.

When asked about the student-loan interest rate debate in Congress, Downs called it “abhorrent. I’m really disappointed in the loan-rate debate.”

Staff Writer Jessica Hall can be contacted at 791-6316 or at:

jhall@pressherald.com

Send questions/comments to the editors.

Comments are no longer available on this story