WASHINGTON – Under pressure from the White House, Senate leaders are quickly moving forward with a plan to change how the government sets interest rates for federal student loans – tying them to market rates but imposing caps on how high those rates can go.

Senate Majority Leader Harry Reid, D-Nev., said Thursday that a vote could come this week, but senators who worked on the proposed legislation said next week is more likely.

A bipartisan group of senators reached a compromise Thursday morning following weeks of negotiations, as Education Department staffers camped out in their offices. On Tuesday, the senators visited the White House to meet with President Obama, who urged them to make a decision.

Under the new proposal, all undergraduates would pay the same interest rate, a change from recent years when some low- and middle-income students received a lower rate. Graduate students and parents of students would pay higher interest rates, although still lower than current rates, with higher caps.

“While this isn’t the agreement any of us would have written – and many would like to see something quite different – I believe that we have come a long way in reaching common ground on a very, very difficult and challenging topic,” Majority Whip Richard Durbin, D-Ill., said at a news conference Thursday afternoon, standing in front of the seven other senators who worked on the legislation.

For the coming school year, undergraduates would see rates of 3.86 percent. That’s lower than the current fixed rate of 6.8 percent, but the new rate could go as high as 8.25 percent in future years.

Graduate students would have a 5.41 percent interest rate for the coming year and up to 9.5 percent in the future. PLUS loans, which can be taken out by parents of students or graduate students, would have an interest rate of 6.41 percent that could go as high as 10.5 percent. Now, graduate students have interest rates of 6.8 percent and PLUS loans are at 7.9 percent.

Under this plan, the government is expected to make $715 million over the next decade. Sen. Lamar Alexander, R-Tenn., said this was not intentional and is the result of small gains on hundreds of billions of loan dollars over 10 years. He said he hopes that the government’s gain will be closer to zero.

“Our goal is to make it neutral, in terms of fair to taxpayers, fair to students,” Alexander said.

Senate Democratic leaders had originally backed a bill that would extend a low interest rate on one type of student loan, buying more time to tackle a full reform.

That legislation failed in a procedural vote, forcing them to work with Republicans on an immediate solution.

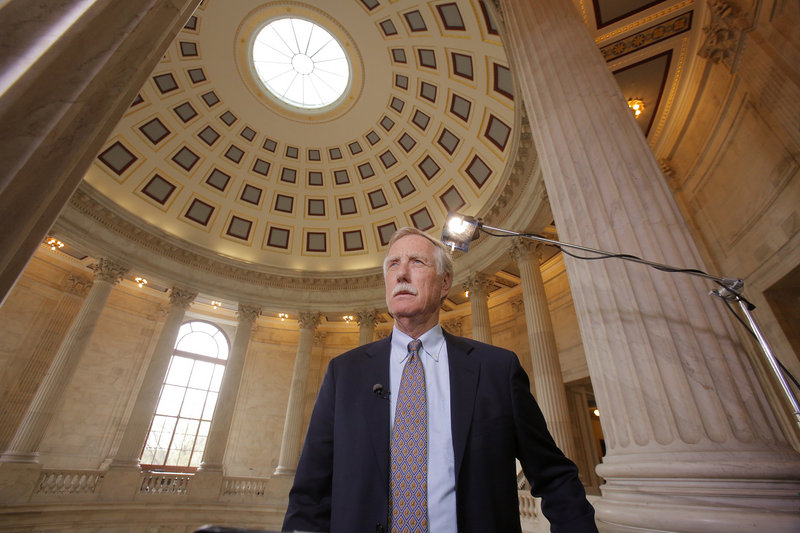

The compromise was based on a bill introduced this year by Joe Manchin III, D-W.Va., Richard Burr, R-N.C., Tom Coburn, R-Okla., Angus King, I-Maine, Thomas Carper, D-Del., and Alexander. The final deal was agreed upon by those six senators, along with Durbin and Sen. Tom Harkin, D-Iowa, chairman of the education committee.

The House has passed its own student loan bill. If the Senate passes its bill, differences between the two will have to be reconciled.

Send questions/comments to the editors.

Comments are no longer available on this story