AUGUSTA — A Republican state senator wants to raise Maine’s tax on earned income over $250,000 a year, but he likely will face opposition from leaders in his party, including Gov. Paul LePage.

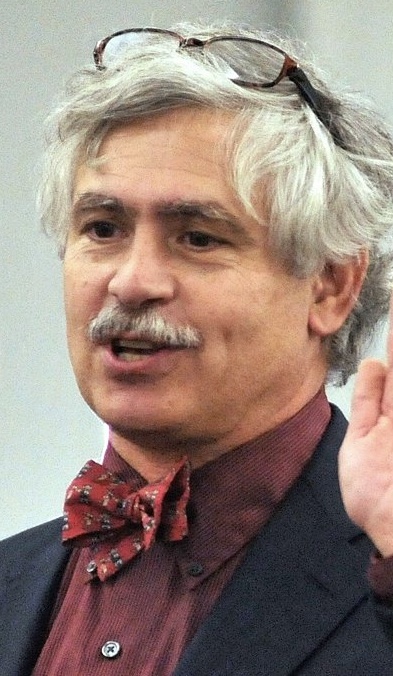

Sen. Tom Saviello, R-Wilton, said Wednesday that he has submitted legislation to raise the tax on high earners from 7.95 percent to 8.5 percent. The higher rate was in effect until 2011, when the Legislature approved a budget from LePage that reduced the rate to its present level.

“When I was on the campaign trail, people asked the question,” Saviello said. “They just couldn’t understand why somebody making more than $250,000 of income couldn’t be taxed more.”

Michael Allen, LePage’s associate commissioner of tax policy, said the change would affect 4,100 Mainers and generate $5 million a year.

The rate would apply only to income from wages and salaries, not from dividends, business, rentals or other sources.

Saviello will have to find a state representative to introduce the bill because the Maine Constitution says all bills raising revenue must originate in the House.

Saviello said he could switch the sponsor’s name to Rep. L. Gary Knight, R-Livermore Falls — who said he would likely put his name on the bill for Saviello once he sees it on paper.

Knight said he supports the 2011 tax cuts and would prefer to see taxes go down for everyone but he hopes Saviello’s proposal can bridge gaps between Republicans and Democrats, who have frequently characterized LePage’s changes as “tax cuts for the rich.”

Maine Revenue Service has estimated that the tax cuts reduced the tax burden for the top 10 percent of Maine earners — more than 67,500 families making around $119,000 or more — by more than $63 million a year. Saviello’s plan would be a small bite into that.

The cuts also eliminated taxes for 70,000 low-income Mainers, by moving a 2 percent tax rate to zero. The top 10 percent of income earners paid more as a percentage of Maine’s overall tax burden after the changes.

“I hope it puts an end to this constant bickering that all we’re doing is looking out for the wealthy,” Knight said of Saviello’s proposal. “If this is what brings the two parties to work together to grow the state, then we can do that.”

Saviello, who left the Democratic Party in 2005, is known as one of the more moderate state legislators.

Senate Minority Leader Michael Thibodeau, R-Winterport, said Saviello’s proposal “isn’t something I’d gravitate towards,” but that may not matter.

“Tom’s an independent thinker — always has been and always will be,” Thibodeau said. “Whether he gets broad-based Republican support for this or not, he’s going to have a public hearing and promote it.”

LePage’s spokeswoman, Adrienne Bennett, said she won’t comment on the legislation until the language is available. But she said LePage will likely stand firm for preserving rate cuts he advocated.

House Minority Leader Kenneth Fredette, R-Newport, said Saviello will likely find “very little support” from House Republicans. He said Maine has a reputation as a high-tax state.

According to the nonpartisan Tax Foundation, Mainers paid an average of 10.3 percent of income in taxes in 2010.

“In a bipartisan fashion, we took action to address that issue last session,” Fredette said. “To go back in and start tweaking with it again before the cuts have virtually even started is irresponsible.”

Democrats were more enthusiastic. Jodi Quintero, spokeswoman for House Speaker Mark Eves, D-North Berwick, said tax adjustments will be on Democrats’ radar. She said Eves’ office is encouraged by Saviello’s outlook.

Saviello said he would like to get Senate Majority Leader Seth Goodall, D-Richmond, to co-sponsor the bill. Goodall said he has had conversations with Saviello but hasn’t yet seen the measure.

Democratic leaders have been vague about their plans for taxes. Saviello’s announced plan is the first one to bite into the 2011 tax cuts.

State House Bureau Writer Michael Shepherd can be reached at 370-7652 or at

mshepherd@mainetoday.com

Send questions/comments to the editors.

Comments are no longer available on this story